Business

16 February 2022

Share

Branded vs non-branded jewelry: the low-down

Will there still be room for non-branded jewelry? Will the jewelry market develop like that of watches and leather goods, which are mostly owned by major international brands?

By Sandrine Merle.

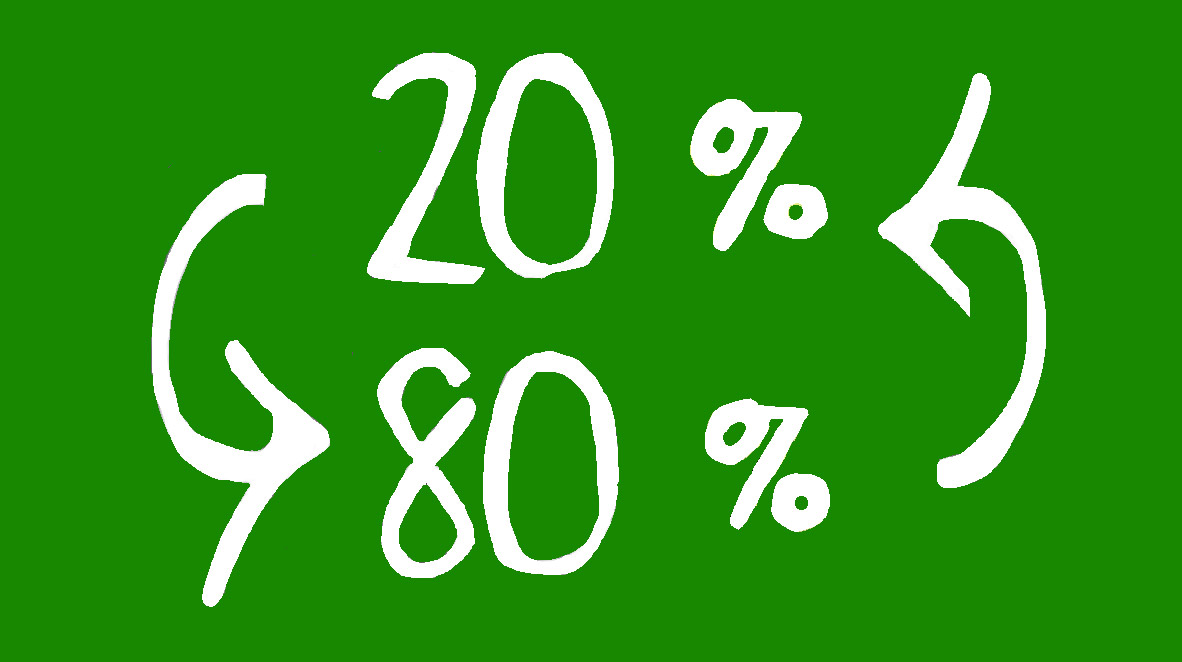

One figure keeps coming up in studies on the global jewelry market: only 20% of the necklaces, rings, bracelets and earrings sold in the world are branded – that is. they bear a famous logo (Van Cleef & Arpels, Cartier, Tiffany, Bulgari, Pomellato, etc.) – while the remaining 80% is made up of ordinary, non-branded jewelry. In fact, from France to India via South America, this sector also comprises small thousands of individual players, with jewelers crafting alone at their workbenches in the streets of Paris, but also in India, Dubai, etc.

80/20

How was this 80/20 figure, repeated in all the studies, calculated? The ratio was concocted by the international groups (Kering, LVMH and Richemont) when they began to buy up the historic jewelers in the early 2000s. They started by calculating the turnover of 30 international brands, which they then deducted from the total world market for precious jewelry. That total was obtained by doubling the only reliably quantified market: the diamond jewelry market. At $84 billion today according to Rubel & Menasche, the latter is estimated to represent half of the total jewelry market, including gold and gemstone jewelry.

80% non-branded

But this indicator only takes into account jewelry from international brands such as China’s Chow Tai Fook (8 billion), Cartier (5 billion estimated), Tiffany & Co. (4.4 billion estimated), or those considered desirable but with a much lower turnover such as Van Cleef & Arpels or Pomellato (8 million). Until now, other significant players were not factored in, such as the American leader in online engagement rings, Blue Nile ($348 million). “The aura is not prestigious enough, or the name not desirable enough to be considered as a motivation to buy,” explains a professional. Also overlooked are medium-sized jewelers, brands like Histoire d’Or or Le Manège à Bijoux, and talented designers who have been mushrooming in recent years, whether from France, Greece like Christina Soubli, the UK like Alexandra Jefford or Lauren Adriana, or numerous Lebanese, etc.

The 80%, a phenomenal piece of the pie

This 80% of non-branded jewelry represents a fabulous source of expansion. The challenge for brands is to replace this rather anonymous jewelry with their own marketed, branded, labeled and logotyped jewelry. According to McKinsey’s forecasts, “By 2025, the proportioin of non-branded jewelry items will fall from 80% to 70%.” Jewelers with an international reputation seem set to be the big winners, with colossal resources deployed, particularly in China: an increase in the number of boutiques, spectacular advertising campaigns, investment in digital, etc. These companies are also the queens of “icons” (Clou, Alhambra, Quatre, Possession, Knot, etc.) – pieces that are recognizable at a glance, produced in millions of copies and the sources of fabulous profits. They have even started to brand their diamonds! The best examples: the “LV Cut” developed by Louis Vuitton, the “Impress Cut” cut by Chaumet. There seems to be no limit to logotyping.

A super-competitive market

McKinsey emphasizes the significance of players that have been underestimated and not taken into account in the 20% branded jewelry figure, such as Blue Nile, Vashi, Mejuri – jewelry platforms with no display great creativity but which aspire to the status of brands. The founder of Vashi, the Spaniard Vashi Dominguez, does not hide his ambitions: to become the biggest jewelry brand in the world! In the long term, faced with these behemoths, will there still be a few percent left over for designers? The kings of creativity, the original and the surprising – those who have a strong identity like Marc Auclert, Codognato, Alice Cicolini, Ted Muehling, Gabriella Kiss, Elene Votsi, Solange Azagury-Partridge, Christopher Thompson Royds, Alina Alamorean (and many others) will surely do very well.

But between the very large and the very small, there will probably be no room for the average – in any sense of the word.

Related articles: