Business

01 March 2021

Share

The French watch and jewelry market in 2020

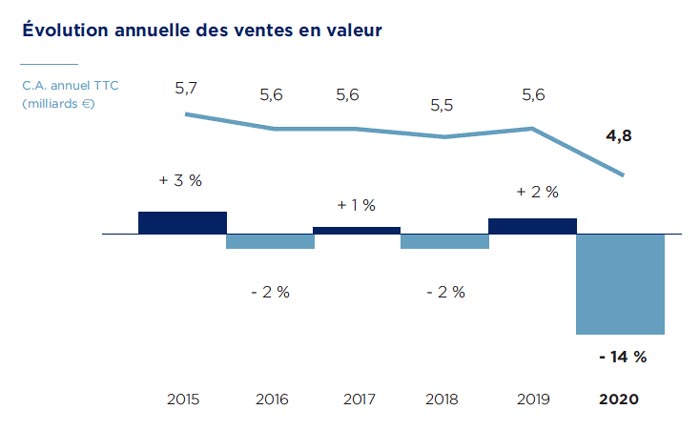

As every year, Francéclat* publishes Panel 5’s study on the watch and jewelry market. It shows a market in shock, for in 2020, its turnover (€4.8 billion) was down by 14%: the biggest drop since 1945. But there are glimmers of hope!

Par Sandrine Merle.

Here are the tops and flops of 2020 with each product category, as revealed by Hubert Lapipe, director of the research company Panel 5.

The losers

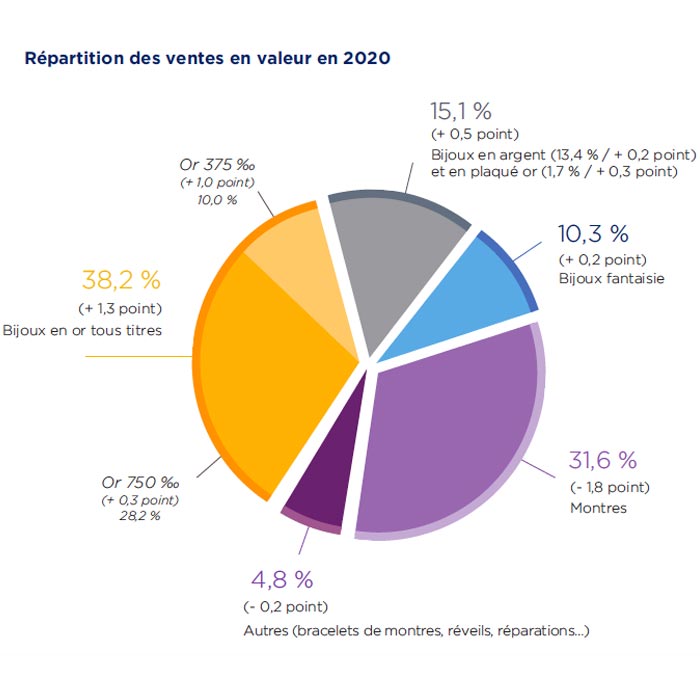

1/ Watches of over €1,000 euros fell by 31%: this was the product segment that saw the sharpest decline, followed by 18 carat gold jewelry, down by 13%. This was due to the closure of physical stores, of course, and the absence of international tourists since January 2020. Department stores and luxury boutiques were the most affected, losing 47% of their turnover. But at the same time, the brands hardest hit (Chanel, Gucci, Van Cleef & Arpels, Cartier, etc.) also posted record sales in China. So the market was not lost: it moved.

2/ There was also another problem for watches of over €1,000 euros and jewelry: a phenomenal rise of nearly 25% in the price of gold. And according to forecasts for 2021, it’s not over yet! The ultimate cause of woe for jewelry was a historic drop in weddings, down by 34%, according to INSEE. There were practically none in April and May. The number of wedding rings, a stalwart of the trade, consequently fell by 32%. On the other hand, people continued to get engaged: the solitaire, the world’s best-selling engagement ring, performed better, mainly thanks to a surge in December.

3/ Affordable jewelry – costume and silver pieces – did not benefit from deferred purchases, but fell back to 2010 levels in value. Hubert Lapipe has a theory about this: “The customers concerned were probably the ones most disadvantaged in these difficult times.” One exception, however, was 9-carat gold, which contains less of the precious metal and absorbs price increases more easily. Today, it is still five times cheaper than 18-carat gold.

The winners

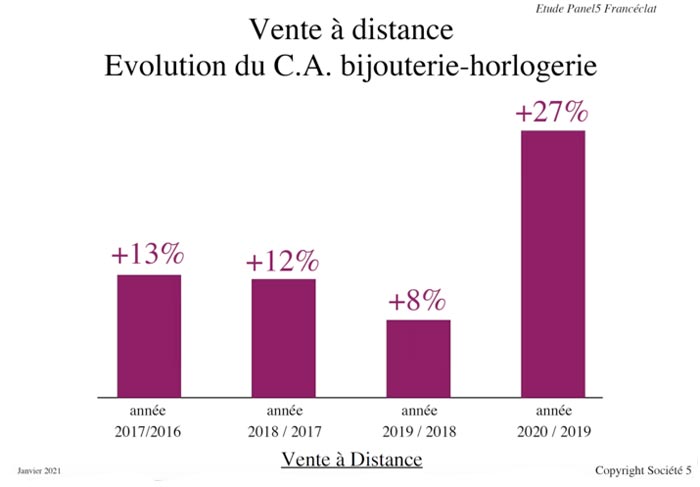

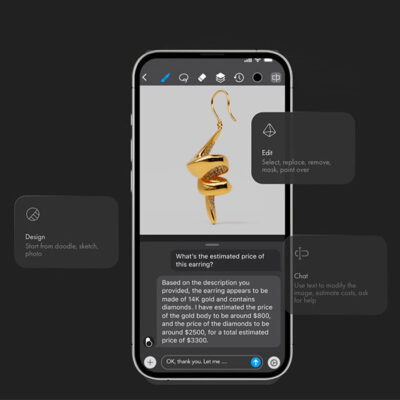

1/ Stimulated by successive lockdowns in 2020, online sales posted a 27% increase in turnover, gaining three years’ growth in one fell swoop. This was mainly thanks to watches. But this extraordinary expansion only managed to offset 3% of sales in stores. “Not all products were available online, as Click and Collect had little impact and consumers were not necessarily ready yet,” says Hubert Lapipe.

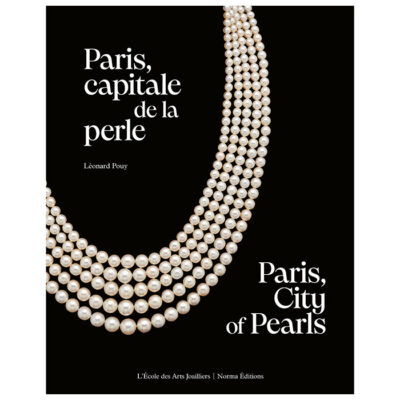

2/ The diamond was in the red because of the lack of foreign customers. But if we consider only the French clientele, it remained in balance. Despite the crisis, there was no spectacular breakthrough with synthetic diamonds, even though they gained from ever-wider distribution, a larger range of products (the new multi-stone wedding ring is very popular) and highly attractive prices. Like for like, a synthetic diamond solitaire is still 50% less expensive than a natural diamond solitaire. A major advantage.

To conclude in a somewhat surprising way, here are some causes for hope…

– Thanks to the reopening of stores in December, which prevented a loss of €1 billion in turnover. Without this reopening, it would have been five times worse than in December 2018 with the Yellow Jacket crisis.

– Thanks to dynamic sales in the French market at each emergence from lockdown: June was an excellent month, as was December, the most remarkable since 2011.

– Excluding sales to foreign customers, sales of watches at over €1,000 and diamond jewelry finished at break-even point, like diamonds: the former at €1.53 billion, the latter at €3.08 billion.

“These unhoped-for results show that jewelry is still highly important for the French,” says Hubert Lapipe. “And even if the crisis continues, it is clear that this is primarily a health crisis and in no way one of consumer demand.” So there’s room for optimism.

*Franceclat, Professional Committee for economic development serving the watch and jewelry sectors. It’s financed by the HBJOAT tax.

Related articles: